Online & Mobile Banking

Digital banking just got even faster, safer, and easier

Use Online and Mobile Banking to access our credit union from anywhere at any time. You can take brighter banking with you wherever you go with our online banking platform or mobile app available on iOS and Android devices.

Use it to keep tabs on your accounts, monitor activity on your debit and credit cards, deposit check, manage budgets, or pay back a friend for dinner with Zelle®.

Jovia Advantages

Move money easily

Take your money to the bank without ever leaving home. You can deposit checks, pay bills, transfer money between accounts, and send money with Zelle® anywhere, anytime.

Control your spending

Set up real-time transaction alerts and receive push notifications whenever a new purchase is made using your card. You can also lock and unlock your card at any time to prevent fraud if your card is lost or stolen.

Monitor your credit

Whether you're looking to maintain your credit score, or working on rebuilding it, you can keep tabs on your credit health and financial fitness with a free quarterly credit score.

Create budgets and stick to them

Say goodbye to spreadsheets and start tracking your spending with MX Money Management. Set savings goals, categorize purchases, and stay on top of your bills so you never miss a payment again.

FREQUENTLY ASKED QUESTIONS

With Jovia Online and Mobile Banking, you can choose the alerts that best fit your needs. Select custom alerts for each account, from large withdrawal/deposit notifications to low and high balance alerts. And, you can even select how you want your alerts to be delivered; through push notification, text message, or email.

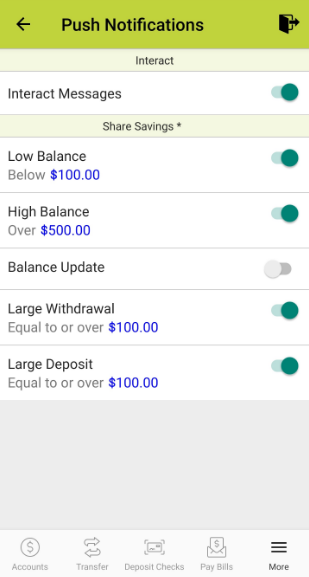

To enable push notifications:

1. Open the Jovia Mobile Banking App. Click on the More menu and tap on the gear icon ⚙️ located in the upper right corner of the screen.

2. Select push notifications.

3. Activate the notifications you want to receive by clicking the switch to the right and setting your desired threshold.

*Ensure your device settings for each device you want to receive alerts on allows notifications from the Jovia app. Not sure how to do this? We can help!

IOS devices: Settings > Notifications > Jovia App > Allow Notifications

Android devices: Setting > Apps > Jovia App > Notifications > Show Notifications

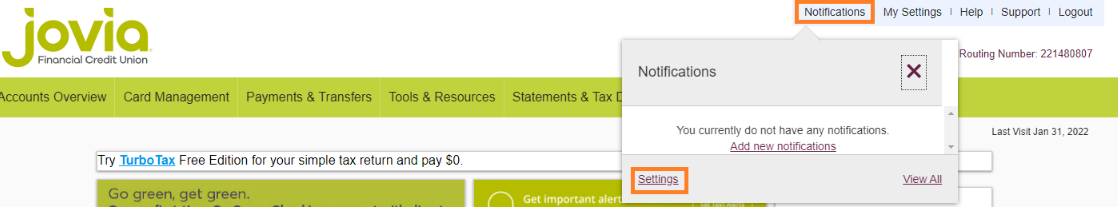

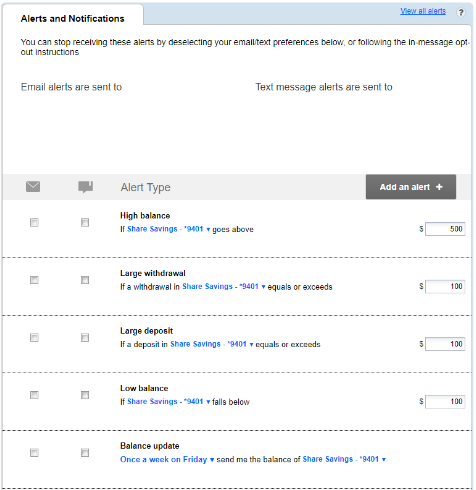

To enable text and email notifications:

1. Sign in to Online Banking. Navigate to notifications on the screen and select settings.

2. Activate the notifications you want to receive by checking the box to the left and your desired threshold.

If this is your first time using this service, you will need to first sign up for Online & Mobile Banking access. You will receive further information via email once your enrollment has been processed. If you are already enrolled in Online & Mobile Banking, you can sign in to access your accounts either using our website, or mobile app.

To reorder checks online:

- Sign into Online Banking

- Click on the Additional Services from the menu

- Select Check Reorder

- Choose the account for which you wish to order checks

- Follow the prompts on the screen to complete your order

When you register for paperless statements, you will be able to view up to 24 months of statements.

- Sign in to Online Banking

- Select Online Statements and Tax Docs from the menu

- You will be presented with a brief disclosure. Once you accept the terms and conditions, you will have access to your current and previous months statements. Up to 24 months of account statements will be available to you.